Europe’s push toward next-generation energy storage received a strategic boost with the announcement of Argylium, a joint venture between Syensqo and Axens. The new company will focus on scaling up advanced materials for solid-state batteries, a technology widely viewed as critical for the next generation of electric vehicles and grid-scale energy storage.

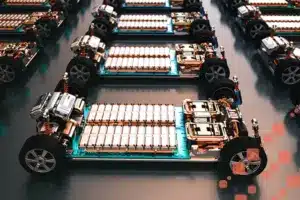

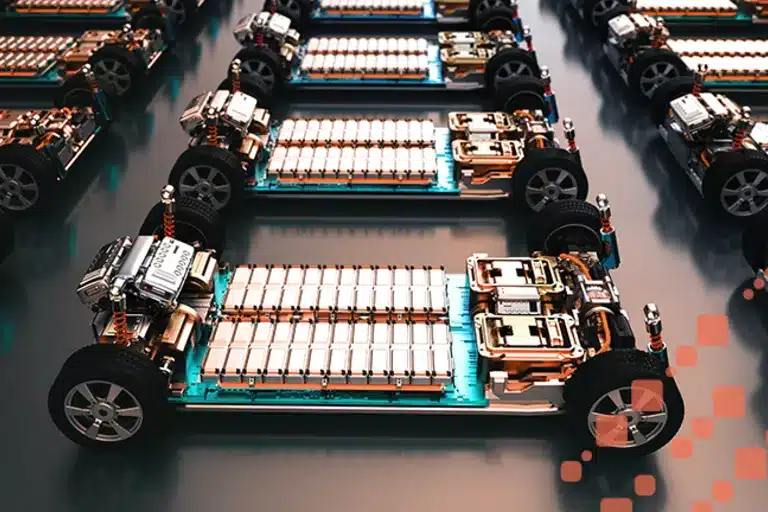

Analysts estimate the global solid-state battery market could exceed $8 billion by 2030, driven by demand for higher energy density and safer battery chemistries. Solid-state batteries replace conventional liquid electrolytes with solid materials, offering intrinsic safety advantages, higher theoretical energy densities, and the potential for faster charging. Yet the technology remains constrained by industrialization challenges, including the scalability of sulfide and oxide solid electrolytes, interface stability, and production costs. Argylium seeks to address these bottlenecks by leveraging Syensqo’s decade-long materials development and pilot-scale experience in La Rochelle, combined with Axens’ expertise in industrial-scale process design and operation of inorganic chemistry plants.

The collaboration also integrates research capabilities from IFPEN’s Lyon center, known for work on oxide and sulfide divided materials. The combined expertise is intended to accelerate the transition from laboratory-scale demonstration to commercial-scale production, a step that has historically limited solid-state battery adoption despite their technical promise. Early-stage trials indicate that sulfide solid electrolytes can achieve ionic conductivities approaching those of liquid electrolytes, but maintaining performance at scale remains a technical hurdle.

Thomas Canova, Head of R&I at Syensqo, highlighted that the partnership aligns with Europe’s broader industrial strategy: developing advanced battery materials for cathodes and establishing recycling capacities for black mass while targeting commercial readiness for solid electrolytes by 2030. By integrating materials innovation with process engineering and industrial know-how, Argylium aims to reduce the time and risk associated with scaling up solid-state battery production.

Fabrice Bertoncini of Axens emphasized the importance of ecosystem building. Argylium plans to collaborate closely with European research institutions, automotive OEMs, advanced battery manufacturers, and energy technology partners. This networked approach is designed to ensure that innovations in material synthesis translate efficiently into high-volume manufacturing and ultimately into EV and stationary storage applications.

Europe faces growing pressure to localize battery production as supply chain dependencies and regulatory frameworks increasingly favor domestic manufacturing. The Argylium initiative reflects a strategic attempt to consolidate capabilities in solid-state electrolytes, which are seen as a differentiator in both vehicle range and safety performance. If successful, the venture could position Europe competitively against Asian and North American players already pursuing commercial solid-state battery programs.

Industrial observers note that the focus on sulfide electrolytes, rather than purely oxide-based systems, represents a pragmatic balance between ionic conductivity and manufacturability. Sulfide-based solid electrolytes offer higher ionic mobility than oxides but require careful handling to avoid moisture sensitivity, an issue Argylium’s combined expertise in materials and industrial chemistry is intended to mitigate.