NAAREA’s validation of plutonium chloride fuel synthesis through collaboration with the European Commission’s Joint Research Centre addresses a critical bottleneck in the molten salt reactor industry, which is projected to reach $41.55 billion by 2031 from $17.71 billion in 2023, growing at a 12.95% CAGR. The French startup’s breakthrough in pyrochemical synthesis of NaCl-PuCl₃ salt from plutonium oxide represents the first systematic validation of proliferation-resistant fuel production methods for fourth-generation microreactors, potentially accelerating commercial deployment timelines across the sector.

The technical achievement occurs within a rapidly evolving advanced nuclear landscape where China became the first nation to operate a demonstration Generation IV reactor in December 2023 with its HTR-PM pebble-bed reactor, while simultaneously developing the world’s first thorium molten salt nuclear power station. NAAREA’s approach to reprocessing spent pressurized water reactor fuel into liquid molten salt fuel could differentiate its XAMR® microreactor in an increasingly competitive field of Generation IV technologies.

Fuel Synthesis Validation and Technical Significance

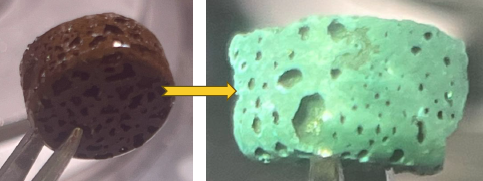

The pyrochemical process validated by NAAREA involves bubbling gas through a mixture of sodium chloride and plutonium oxide at high temperatures, enabling quantitative dissolution of plutonium oxide to form plutonium chloride-based salt. This method addresses fundamental challenges in creating liquid fuel for molten salt reactors, where the absence of industrial-scale fuel production capabilities has constrained technology development across the sector.

The collaboration with JRC provides NAAREA access to specialized experimental equipment and expertise necessary for handling plutonium-bearing materials under controlled laboratory conditions. The quantitative dissolution achievement demonstrates the technical feasibility of the proposed fuel synthesis route, though scale-up challenges remain unaddressed in current validation work.

Laboratory-scale success requires significant engineering development to achieve industrial-scale fuel production capabilities. The process must demonstrate reproducibility, quality control, and economic viability at production scales necessary to support commercial reactor operations. Current validation work focuses on fundamental chemistry rather than manufacturing engineering requirements.

Strategic Positioning in Advanced Nuclear Competition

NAAREA’s XAMR® microreactor combines liquid fuel molten salt technology with fast neutron spectrum operation and small modular reactor packaging, targeting the projected global market of approximately 570 microreactor units averaging 5 MWe by 2030, representing 2,850 MWe total capacity. However, this projection predates recent acceleration in advanced nuclear development programs and may underestimate actual market potential.

The startup’s 2,400 square meter I-Lab facility in Cormeilles-en-Parisis provides non-nuclear testing capabilities for thermohydraulic components, materials validation, and process engineering development. The facility houses approximately 20 engineers and represents a significant infrastructure investment for a company developing unproven technology, highlighting the capital-intensive nature of advanced nuclear technology development.

NAAREA’s partnership with CNRS and Paris-Saclay University through the Innovation Molten Salt Lab creates a research infrastructure aimed at European leadership in molten salt chemistry. This institutional framework provides academic research capabilities while supporting commercial technology development, though similar public-private partnerships exist among competing advanced nuclear developers globally.

Market Context and Competitive Dynamics

The molten salt reactor market encompasses multiple technology approaches, with most current development focusing on thorium fuel cycles rather than plutonium-based systems. The majority of industry interest centers on using thorium to breed fissile uranium-233, contrasting with NAAREA’s plutonium chloride approach that addresses existing nuclear waste streams rather than requiring thorium supply chain development.

China’s substantial investment of approximately $500 million in thorium research from 2011 to 2021 demonstrates the capital requirements for advanced molten salt reactor development. NAAREA’s funding levels have not been publicly disclosed, raising questions about the company’s ability to compete with well-funded national programs and established nuclear technology companies pursuing similar objectives.

The startup’s waste-burning approach addresses growing concerns about long-lived radioactive waste management while potentially reducing fuel costs through utilization of existing plutonium inventories. However, regulatory frameworks for reprocessing and utilizing plutonium-bearing fuels remain complex and vary significantly across potential markets, creating deployment barriers independent of technical performance.

Technical Risks and Development Challenges

Molten salt reactor technology faces inherent challenges related to corrosion management, tritium handling, and maintenance of radioactive salt systems. NAAREA’s plutonium chloride fuel introduces additional complexity compared to uranium-only systems, requiring specialized handling procedures and enhanced proliferation safeguards throughout the fuel cycle.

The company’s digital twin development approach using Dassault Systèmes’ 3DEXPERIENCE platform enables virtual reactor lifecycle management within 18 months, demonstrating rapid conceptual development capabilities. However, virtual modeling cannot replace physical demonstration of molten salt system operation under realistic conditions, particularly for plutonium-bearing fuel chemistry.

Scale-up from laboratory synthesis to industrial fuel production requires significant process engineering development beyond current validation work. The transition from gram-scale laboratory experiments to kilogram-scale industrial production involves heat transfer, mass transfer, and process control challenges that may reveal unforeseen technical barriers.

Regulatory and Market Access

Plutonium-based fuel systems face stringent regulatory oversight and international safeguards requirements that could complicate licensing and deployment across multiple jurisdictions. NAAREA’s proliferation-resistant synthesis method addresses some security concerns but does not eliminate the regulatory complexity associated with plutonium handling and transportation.

The microreactor market remains largely theoretical, with limited demonstrated demand from potential customers despite optimistic capacity projections. Industrial users considering microreactor deployment typically require proven technology with established operational track records, favoring established nuclear technology suppliers over startups with undemonstrated systems.

Commercial viability depends on achieving cost competitiveness with alternative energy sources while meeting stringent nuclear safety and security requirements. The capital-intensive nature of nuclear technology development creates substantial financial risks for early-stage companies lacking diversified revenue streams or established customer relationships.

NAAREA’s fuel synthesis validation represents progress toward addressing critical technology gaps in molten salt reactor development, though commercial success requires overcoming substantial engineering, regulatory, and market challenges that extend well beyond laboratory-scale chemistry achievements. The company’s approach to utilizing existing nuclear waste streams provides potential advantages in waste management and fuel costs, but these benefits must be demonstrated through full-scale reactor operation rather than laboratory experiments.