A mid-double-digit million euro framework agreement signals Rheinmetall’s serious entry into the hydrogen logistics sector, as the company announces a letter of intent from a leading European green hydrogen producer for its advanced Multiple-Element Gas Containers (MEGCs). The order, covering 100 modular units, is scheduled for delivery starting in early 2026 and underscores intensifying momentum around scalable hydrogen transport infrastructure as Germany accelerates toward climate neutrality by 2045.

This move comes amid a broader supply chain challenge in the hydrogen sector: transporting large quantities of compressed hydrogen efficiently, safely, and cost-effectively. The German National Hydrogen Strategy projects that hydrogen demand will rise to 90–110 TWh by 2030, yet the current pipeline and transport infrastructure falls far short. MEGCs—modular units used to move compressed gas by road, rail, and inland waterways—are increasingly being viewed as a near-term logistics bridge, particularly for industrial offtakers not connected to future hydrogen backbone networks.

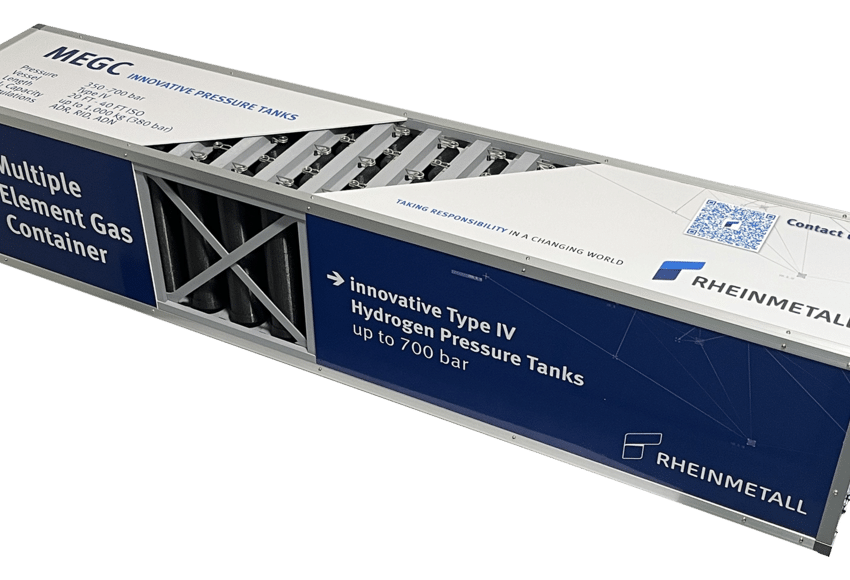

Rheinmetall’s MEGCs integrate Type-IV pressure vessels capable of storing hydrogen at up to 700 bar, which is on the higher end of standard pressure regimes and allows for increased payloads. Each unit can store up to 1,000 kg of hydrogen at 380 bar, with designs scalable from 20 to 40 feet in length. The containers meet all relevant safety standards for road (ADR), rail (RID), and barge (ADN) transport, offering logistical flexibility critical for early-stage hydrogen market development.

The use of advanced Type-IV tanks also signals a trend in engineering optimization. Rheinmetall reports reductions in carbon fiber usage and shorter winding times—both significant for cost reduction in composite pressure vessels, historically a CAPEX-intensive element of hydrogen transport solutions. While the company has not disclosed specific performance metrics beyond storage volume, the emphasis on manufacturing efficiency suggests a focus on lowering the cost per delivered kilogram of hydrogen, a key benchmark as hydrogen struggles to compete with incumbent fuels.

Yet the scale of this first order, while notable, highlights the infancy of hydrogen transport infrastructure relative to projected needs. A 1,000 kg capacity per container multiplied by 100 units represents 100 metric tons of hydrogen, insufficient to meet even a fraction of the 2030 targets without broader infrastructure deployment. However, this order provides a commercial proof point for Rheinmetall’s hydrogen ambitions, which span production, distribution, and fuel cell systems.

Importantly, the framework agreement complements Rheinmetall’s broader strategy to diversify beyond its core automotive and defense segments. The Power Systems division is being positioned as a multi-sector supplier for hydrogen applications, including BoP components for fuel cells and electrolyzers. This integration approach aligns with decarbonization goals, but also reveals the technological fragmentation still present in the sector. Industry stakeholders are seeking end-to-end solutions across the hydrogen value chain, but few companies currently offer vertically integrated offerings with commercial traction.

Rheinmetall’s expansion into hydrogen logistics follows similar moves by players like Hexagon Purus, CIMC Enric, and Worthington Industries, all developing MEGC or high-pressure transport technologies. Competitive differentiation will hinge not only on vessel performance and compliance but also on lifecycle costs, availability of servicing infrastructure, and compatibility with diverse regional regulatory frameworks.

The timing of the LOI also coincides with a shifting regulatory environment. The EU’s revised Gas Package includes specific language around hydrogen market design, third-party access, and cross-border infrastructure planning. As the bloc transitions from fragmented national policies to a more unified hydrogen transport vision, players with compliant and scalable logistics solutions may find early-mover advantages.

Rheinmetall’s ability to convert this initial commitment into long-term contracts will depend on execution and cost performance. Promising talks with other potential customers were noted but not quantified, and no mention was made of partnerships with trailer or refueling station operators—an important piece of the ecosystem for containerized hydrogen. Nevertheless, this development marks a critical litmus test for whether the company’s hydrogen strategy can generate recurring revenue in a still-uncertain market.

In a sector where infrastructure remains the bottleneck, Rheinmetall’s entry into modular hydrogen logistics highlights both the urgency and the complexity of decarbonized energy delivery. The coming years will test not just the engineering of high-pressure vessels but the viability of containerized hydrogen as a scalable solution amid accelerating climate policy and industrial decarbonization demands.