As the EU intensifies its push toward decarbonization, the hydrogen sector faces a new layer of regulatory scrutiny—and opportunity. By 2030, 42% of industrial hydrogen use across the bloc must come from renewable fuels of non-biological origin (RFNBO), a category that includes green hydrogen. Within this tightening framework, Nobian’s recent acquisition of ISCC EU certification for its green hydrogen signals both regulatory readiness and strategic positioning within a fast-evolving market.

The certification, issued by independent verifier Normec QS, confirms that Nobian’s hydrogen meets the EU’s stringent RFNBO criteria: produced using renewable electricity, demonstrating full traceability, and emitting substantially lower lifecycle CO₂ emissions compared to fossil-based alternatives. For a sector long grappling with the gap between technical feasibility and commercial viability, such certifications are becoming a critical gatekeeper for market access, especially as refineries and fuel suppliers seek compliant molecules to meet upcoming EU mandates.

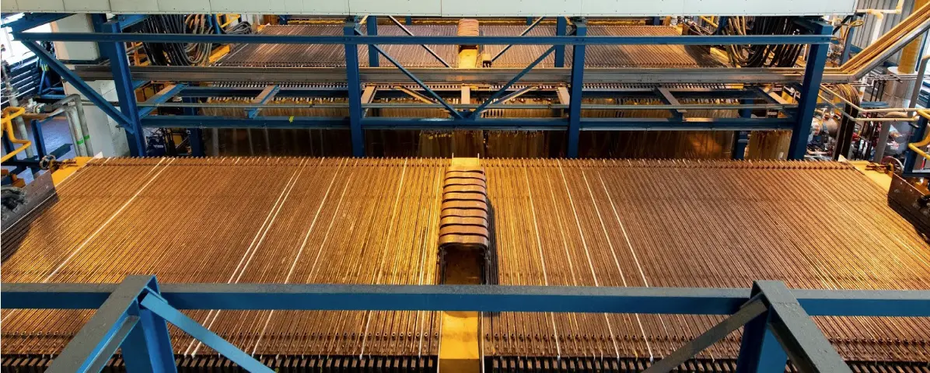

The RFNBO framework, introduced under the Renewable Energy Directive (RED II and revised in RED III), not only quantifies emission thresholds but also establishes temporal and geographical correlation rules. Green hydrogen must be produced in sync with renewable electricity generation and within specific regions, conditions that require robust systems for data tracking and verification. Nobian’s chlor-alkali electrolysis process, which converts salt and water into chemicals including hydrogen, is now demonstrably compliant when powered by renewable sources.

The emissions gap between green and grey hydrogen remains stark. According to the International Energy Agency, traditional hydrogen production emits roughly 10 kg of CO₂ per kg of hydrogen. In contrast, when powered entirely by renewables, green hydrogen’s emissions can approach near-zero, depending on upstream impacts. Nobian claims its process emits ten times less CO₂ than grey hydrogen, a figure consistent with broader industry benchmarks, although lifecycle analysis can vary based on grid mix and production intermittency.

While Nobian’s RFNBO certification is currently limited to one production site, plans are underway to expand certification across facilities in the Netherlands and Germany. This expansion is not merely symbolic. For industrial users—particularly those in chemicals, steel, and refining—sourcing certified green hydrogen is becoming both a regulatory and reputational imperative. The demand signal is clear: EU legislation stipulates that at least 1% of transport fuels must come from RFNBO by 2030, creating a market where certified supply chains will dictate competitiveness.

But certification alone won’t guarantee market traction. Green hydrogen still contends with significant cost disparities. In most EU countries, it remains two to four times more expensive than grey hydrogen, largely due to electrolyzer costs, renewable electricity prices, and infrastructure limitations. Certification may enable access to subsidies or contract-for-difference schemes, but it doesn’t solve the fundamental economics, yet.

Still, Nobian’s move reflects a broader trend: the integration of certification, digital tracking, and compliance reporting as foundational pillars of the emerging hydrogen economy. These mechanisms are no longer add-ons but prerequisites for participation in a market shaped by carbon accounting, not just kilowatt-hours or kilograms of gas. As Nobian’s Senior Vice President, Markus Mingenbach emphasized, certification opens access to new markets—both in terms of geography and sector—and reinforces the role of hydrogen as a clean molecule embedded in industrial processes, not just mobility hype.

The chlor-alkali industry, often overlooked in the public hydrogen discourse dominated by mobility and power, is in fact one of the largest captive hydrogen users in Europe. It offers a unique pathway to scale up green hydrogen in existing chemical value chains with lower marginal infrastructure demands. Nobian’s certification thus positions it to play a quiet but pivotal role in accelerating adoption where hydrogen is already integral to production, not an optional retrofit.

As more producers pursue RFNBO certification, the emphasis will shift from pilot projects to standardized practices. The market’s next challenge lies not in proving what’s possible but in demonstrating what’s repeatable, scalable, and verifiable. In that context, Nobian’s certification isn’t just a regulatory milestone—it’s a litmus test for the emerging green hydrogen economy’s ability to meet its own promises.