The circular economy market reached $553 billion to $ 556 billion in 2023, positioning it as one of the fastest-growing sectors in the global economy. While ESG-branded investments hemorrhage capital—with record outflows of $8.6 billion in Q1 2025 alone—circular economy principles are gaining traction through raw economic necessity rather than ideological positioning.

This distinction proves critical. Unlike ESG investing, which increasingly faces political headwinds, circular business models are advancing because they deliver measurable cost advantages and supply chain resilience. The sector’s growth trajectory reflects fundamental shifts in energy costs, resource scarcity, and manufacturing efficiency that transcend political cycles.

Technology Convergence Drives Market Acceleration

Four interconnected technological disruptions are reshaping industrial production systems: energy, transport, food, and information technologies. Solar photovoltaic costs have dropped 90% over the past decade, while battery storage costs have fallen by a similar margin. This energy transition creates cascading effects across circular economy applications, making previously uneconomical recycling and remanufacturing processes financially viable.

Electric vehicle adoption follows a classic exponential curve, with global market share doubling repeatedly over recent years. The transportation electrification trend directly benefits circular models through second-life applications for EV batteries in stationary storage systems, converting end-of-life liabilities into revenue streams.

Perhaps most disruptive is precision fermentation technology in food production. Cost declines in cellular agriculture could eliminate the need for 2.7 billion hectares currently used for livestock and feed crops within two decades, freeing vast land areas for alternative uses while dramatically reducing resource intensity in protein production.

Economic Fundamentals Eclipse Sustainability Rhetoric

Market analysis reveals that the growth of the circular economy is driven by hard economics rather than environmental concerns. Resource efficiency translates directly to cost savings as companies extract more value from each unit of material input. Recycling rare earth elements from electronic waste often costs less than mining new materials, particularly given volatile commodity prices and geopolitical supply risks.

Supply chain fragility exposed during recent global disruptions has accelerated corporate interest in “materials sovereignty”—securing critical inputs through domestic recycling loops rather than international commodity markets. This approach reduces exposure to trade tensions, natural disasters, and political instability that can disrupt linear supply chains.

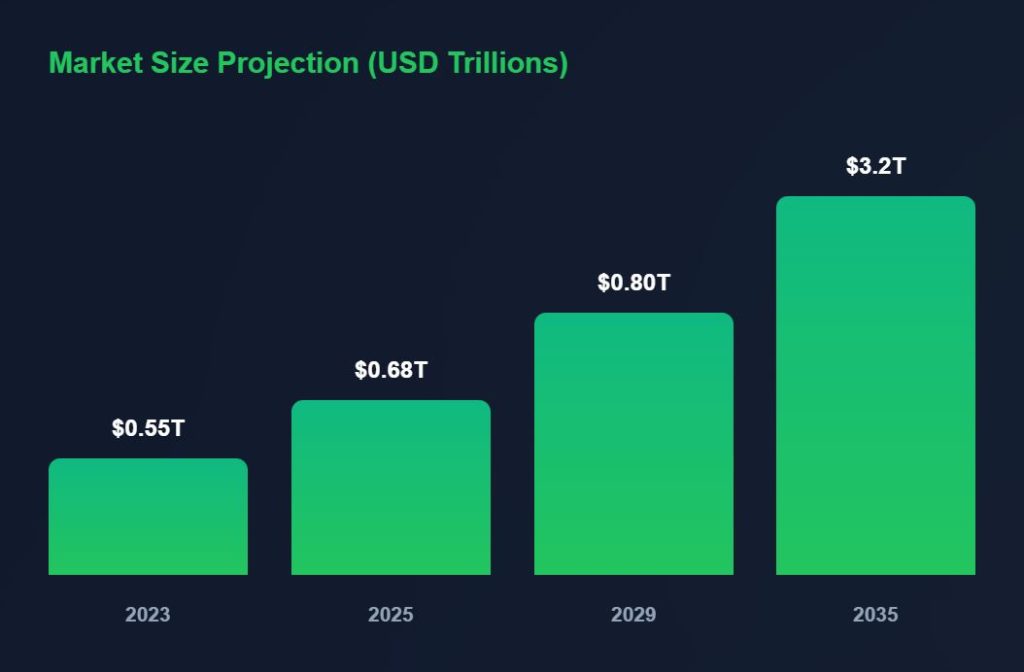

Analysts project the global circular economy market will reach $798.3 billion by 2029 at an 11.4% compound annual growth rate, though these forecasts likely underestimate the sector’s potential. More aggressive projections show growth rates of 13-22% annually, reaching $1.9-3.2 trillion by the early 2030s.

However, conventional market studies fail to account for cross-sector feedback loops and technology learning curves that could accelerate adoption. When renewable energy costs drop below $20 per megawatt-hour—already achieved in multiple markets—energy-intensive recycling processes become economically superior to virgin material extraction across numerous industries.

Policy Environment Shifts Investment Flows

The regulatory landscape increasingly favors circular approaches through waste disposal costs, recycled content mandates, and carbon pricing mechanisms. The European Union’s Circular Economy Action Plan and China’s circular economy legislation create structural advantages for companies designed around material loops rather than linear throughput.

These policy tailwinds operate independently of ESG investing trends. While U.S. sustainable funds have experienced ten consecutive quarters of outflows totaling $19.6 billion in 2024, circular economy investments attract capital based on operational efficiency and risk mitigation rather than sustainability metrics.

The ESG exodus benefits circular economy ventures by removing the “woke capitalism” stigma that has attached to environmental investing under the current political climate. Investors increasingly focus on “future-proof” assets that align with technological and resource trends rather than corporate responsibility scorecards.

Technology Maturation Reaches Commercial Thresholds

Digital tracking systems using blockchain and RFID technology now enable cost-effective product recovery at end-of-life. Internet of Things sensors support predictive maintenance programs that extend asset lifespans and optimize reuse timing. Advanced recycling techniques for complex products—lithium batteries, wind turbine blades, mixed plastics—have achieved commercial viability in multiple applications.

These technological advances combine with economies of scale as circular enterprises grow. What began as niche “eco” initiatives has evolved into competitive industrial practices that often outperform traditional linear approaches on pure cost metrics.

The digital circular economy segment demonstrates particularly strong growth, with market size expanding from $2.86 billion in 2024 to a projected $25.40 billion by 2034 at a 24.4% compound annual growth rate. This subsector benefits from artificial intelligence optimization of supply chains, predictive analytics for equipment maintenance, and digital product passports that enable material tracking throughout product lifecycles.

Market Dynamics Challenge Conservative Projections

Current market forecasts likely underestimate circular economy growth potential due to analytical blind spots. Most studies treat energy, transport, food, and information systems as independent markets, missing the reinforcing effects between sectors. They also assume static energy prices and policy environments, ignoring the accelerating cost declines in renewable energy and battery storage.

A more dynamic analysis incorporating cross-sector feedback loops and learning curve effects suggests market development in three phases. Initial enablement technologies reach cost parity through 2027, driving approximately 20% annual growth as first movers scale operations. Policy and finance structures then flip between 2028-2035, making circular approaches the default choice and accelerating growth to 30-35% annually. Market saturation of core material flows occurs post-2035, with growth moderating to GDP-plus levels as service-based models dominate.

This trajectory would push market value toward $8-10 trillion by 2035, representing approximately 8% of projected global GDP and significantly exceeding current conservative estimates.

Investment Thesis Beyond ESG

The circular economy’s rise reflects systemic economic fundamentals rather than ethical preferences, making it politically resilient and financially robust. Unlike ESG investing, which faces continued outflows and political opposition, circular business models advance through competitive advantage in cost, efficiency, and supply security.

Resource constraints and climate volatility will intensify regardless of political cycles or environmental policies. Companies and nations that build circular capabilities now position themselves advantageously for an era of expensive raw materials and unreliable supply chains. This represents a thesis of prosperity through necessity and innovation rather than corporate responsibility initiatives.

The sector’s growth trajectory suggests investors who dismiss circular economy opportunities as “green” investments may miss one of the defining economic transformations of the 21st century. The numbers indicate this market expansion is driven by the same technological and economic forces that disrupted telecommunications, computing, and retail over previous decades—fundamental changes in cost structures and operational capabilities that render previous business models obsolete.