Global energy systems are entering a period of historic turbulence, as governments face overlapping crises across oil, gas, minerals, and electricity supply chains.

The International Energy Agency’s (IEA) 2025 World Energy Outlook (WEO) warns that energy security has become a structural vulnerability in a world increasingly dependent on electricity, data infrastructure, and critical minerals.

The WEO-2025 presents three policy-driven scenarios, not forecasts, that outline distinct trajectories for energy demand, emissions, and supply diversification. While each pathway reflects different policy intensities, all converge on one reality: energy security challenges now span every major fuel and technology.

Global energy demand continues to expand, led not by China, whose energy-intensive growth has plateaued, but by emerging economies in South and Southeast Asia, the Middle East, Africa, and Latin America. Together, these regions are reshaping global trade and investment flows, driving demand for electricity, mobility, and industrial inputs.

Since 2010, China alone has accounted for half of global oil and gas demand growth and 60% of electricity demand growth. Yet no nation or bloc is expected to replicate its scale of industrial expansion, signaling a more fragmented global energy landscape. The IEA projects that, by 2035, 80% of global energy consumption growth will come from regions with high solar potential, creating new opportunities but also new dependencies.

Energy Security Beyond Oil and Gas

Traditional risks centered on oil and gas supply disruptions are now matched by vulnerabilities in critical mineral supply chains, the backbone of electrification technologies. A single country dominates refining for 19 of 20 energy-related strategic minerals, with an average 70% global market share. These minerals—ranging from nickel and cobalt to lithium and rare earths—are indispensable not only for power grids and batteries but also for semiconductors, AI systems, and defense applications.

Since 2020, concentration in refining has intensified, especially for nickel and cobalt, slowing diversification efforts. The IEA notes that announced projects suggest limited near-term progress, underscoring the need for government-led action on strategic stockpiles, recycling, and alternative supply routes.

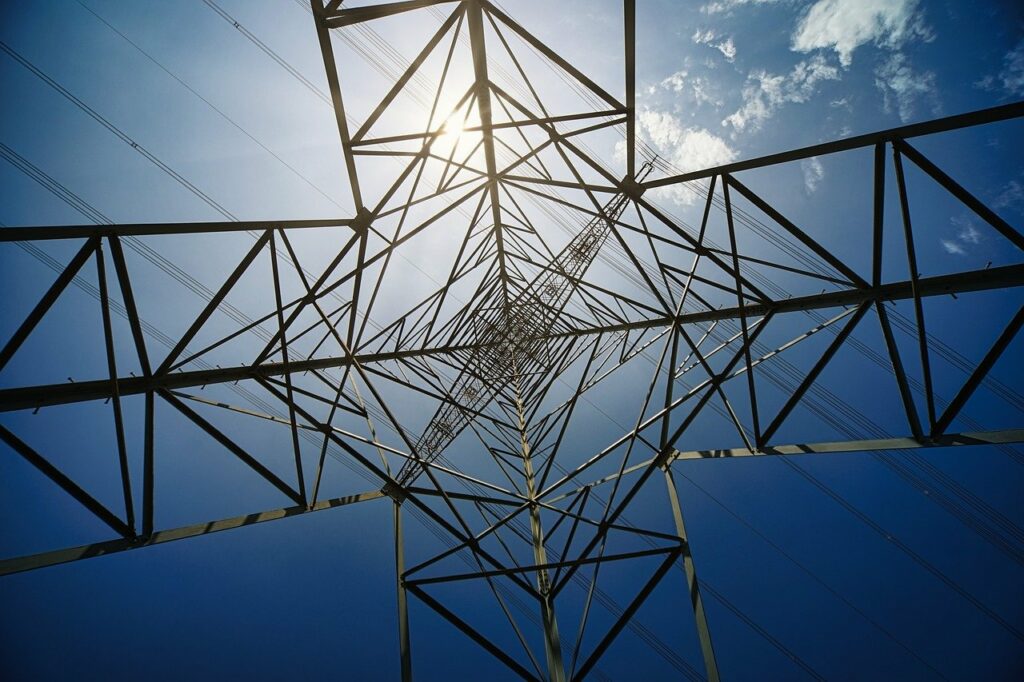

The “Age of Electricity” Takes Hold

Electricity now accounts for 20% of final energy consumption globally but drives over 40% of global economic activity. Spending on electricity supply and end-use electrification already comprises half of total global energy investment. According to IEA Executive Director Fatih Birol, the world has decisively entered what he calls “the Age of Electricity.”

However, while investment in power generation has surged 70% since 2015, grid investment has lagged at less than half that rate. This mismatch threatens system flexibility and reliability, particularly as AI, data centers, and electrified industries drive unprecedented demand growth in advanced economies. Global investment in data centers alone is set to reach $580 billion in 2025, surpassing the $540 billion allocated to oil supply, an inflection point that redefines the hierarchy of energy priorities.

Despite geopolitical tensions, near-term oil and gas supplies appear ample, keeping oil prices stable in the $60–$65 per barrel range. A wave of new liquefied natural gas (LNG) capacity—totaling 300 billion cubic meters per year by 2030—is expected to lift global supply by 50%. The United States and Qatar together account for about 70% of this new capacity.

Yet, the WEO cautions against complacency: weak transition policies or unexpected demand rebounds could rapidly absorb excess capacity, exposing markets once again to volatility.

Two core goals, universal energy access and climate stabilization, remain unmet. Nearly 730 million people still lack electricity, and 2 billion rely on biomass and other polluting fuels for cooking. A new IEA scenario outlines how universal access could be achieved by 2035 for electricity and 2040 for clean cooking, with liquid petroleum gas (LPG) playing a transitional role.

All scenarios in WEO-2025 see the world surpassing the 1.5°C threshold in the short term, even under accelerated decarbonization. The net-zero pathway by 2050 remains technically achievable but increasingly constrained by slow policy implementation and infrastructure bottlenecks.

Energy systems are already under strain from rising climate impacts. In 2023 alone, disruptions to critical energy infrastructure affected over 200 million households, with grid failures responsible for 85% of incidents. The IEA warns that resilience, both physical and cyber, must now be treated as a central pillar of energy security, not an afterthought.

Stay updated on the latest in energy! Follow us on LinkedIn, Facebook, and X for real-time news and insights. Don’t miss out on exclusive interviews and webinars—subscribe to our YouTube channel today! Join our community and be part of the conversation shaping the future of energy.