BP has exited its joint development of the 250MW H2-Fifty project in the Port of Rotterdam—a decision that signals both strategic recalibration and the financial headwinds confronting early-stage electrolytic hydrogen ventures. HyCC, BP’s former partner, will instead pursue a similarly sized standalone project, H2Next, shifting timelines and partnerships but retaining ambition in Europe’s largest port.

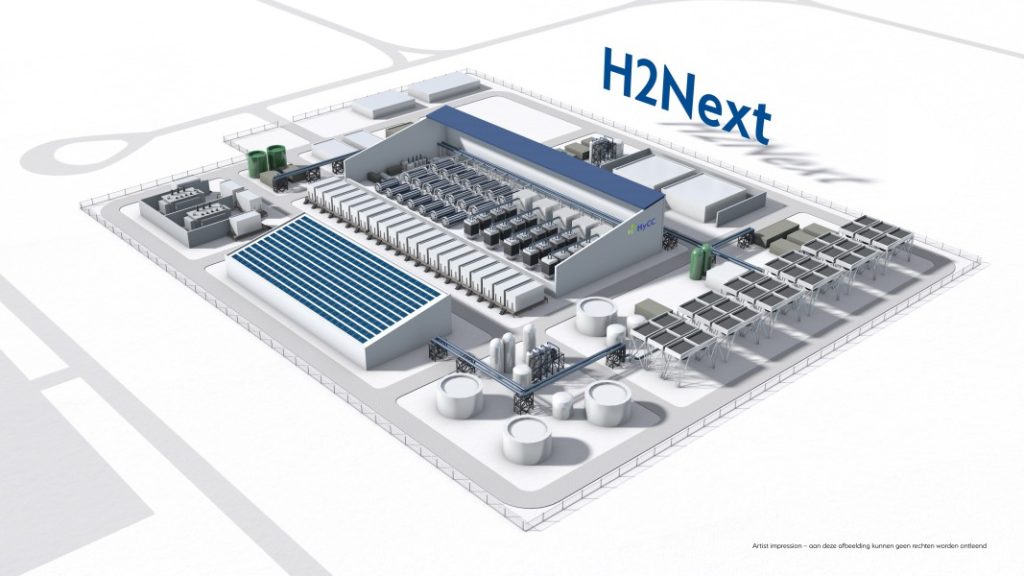

Originally envisioned as a major milestone in Rotterdam’s decarbonization roadmap, H2-Fifty aimed to supply up to 20% of the port’s industrial hydrogen demand. Its discontinuation underscores the increasing difficulty of aligning corporate risk appetites, project financing, and long-term offtake in today’s volatile hydrogen market. HyCC’s pivot to H2Next—a 25,000-tonne-per-year green hydrogen facility now planned independently—reflects a growing trend: focusing on modular, port-centric projects with diversified downstream demand.

The new project will remain geographically strategic. HyCC has secured land in the Port of Rotterdam’s hydrogen conversion park on the Maasvlakte, near the expected grid connection points for several major offshore wind farms. This proximity positions H2Next to benefit from clean electricity supply, a critical factor in lowering the levelized cost of hydrogen (LCOH) amid an EU policy landscape that increasingly rewards renewable hydrogen with stricter carbon accounting.

Yet, H2Next’s timeline—targeting a final investment decision in 2028 and first hydrogen in 2030—pushes commercial operation well into the next decade. This raises broader questions about the feasibility of the EU’s 2030 target to produce ten million tonnes of renewable hydrogen domestically. At just 25,000 tonnes annually, H2Next would account for only 0.25% of that goal, underscoring the scale challenge ahead.

Unlike its predecessor H2-Fifty, which had the backing of an oil major, H2Next emerges as a standalone project from HyCC, a joint venture of Nobian and Macquarie’s Green Investment Group. This structural change could provide greater flexibility in project design and financing, but it also removes a key balance sheet player that could have derisked long-term offtake through integrated refinery operations.

HyCC’s development strategy hinges on connectivity. By aligning H2Next with the Dutch national hydrogen backbone and the future Delta Rhine Corridor, the company intends to position the plant not only as a local supplier but also as a regional hub serving industrial clusters across Northwest Europe. This ambition dovetails with broader EU infrastructure goals, but the regulatory and permitting environment for cross-border hydrogen flows remains fragmented and underdeveloped.

The pivot from H2-Fifty to H2Next also reflects evolving views on project scalability and bankability. Large-scale electrolyzers—especially those exceeding 100MW—still struggle to attract final investment decisions in the absence of long-term subsidies or binding offtake agreements. With power prices remaining volatile and electrolyzer CAPEX stubbornly high, smaller, more flexible projects tied to specific industrial use cases are increasingly favored.

Stay updated on the latest in energy! Follow us on LinkedIn, Facebook, and X for real-time news and insights. Don’t miss out on exclusive interviews and webinars—subscribe to our YouTube channel today! Join our community and be part of the conversation shaping the future of energy.