Global hydrogen projects increased from 200 to over 1,500 between 2021 and 2024, a 650% expansion that positions specialized insurance coverage as a critical enabler for the sector’s $680 billion investment pipeline through 2030, according to Allianz Commercial analysis. The projected $3 billion insurance market by decade’s end reflects not optimism but rather acute recognition of inherent industrial risks that distinguish hydrogen infrastructure from conventional energy systems.

Total announced hydrogen investments increased 20% from $570 billion to $680 billion between October 2023 and May 2024, indicating accelerating project development despite persistent safety concerns. Around 60 governments have adopted hydrogen strategies, yet insurance market growth suggests that policy support cannot eliminate fundamental risk factors associated with hydrogen production, storage, and transport.

Process failures can lead to hydrogen and oxygen mixing, potentially resulting in fires or explosions within electrolyzers, compression systems, or storage equipment, according to Marsh analysis. These technical risks require specialized coverage that extends beyond traditional energy infrastructure insurance models, creating new market segments that insurers must evaluate without extensive actuarial precedent.

Europe leads global hydrogen deployment with 617 projects representing $199 billion in announced investment, yet this concentration intensifies risk exposure across interconnected infrastructure systems. The Allianz report’s emphasis on “chain defects due to equipment replication” highlights scalability challenges where manufacturing standardization potentially amplifies systemic risk across multiple installations.

Investment spending on electrolysis projects could rise by 150% in 2024, based on recent final investment decisions, yet this acceleration occurs without corresponding maturation of safety protocols and risk management frameworks. Insurance market development suggests that coverage availability may become a constraining factor for project financing as underwriters assess unfamiliar risk profiles.

The insurance market’s focus on energy, natural resources, civil liability, property, and transportation risks reflects hydrogen’s cross-sector impact beyond traditional energy infrastructure boundaries. Unlike renewable energy projects with established risk profiles, hydrogen systems introduce novel failure modes that require comprehensive assessment across production, distribution, and end-use applications.

Allianz’s projection methodology remains undisclosed, yet the precision of $3 billion premium estimates suggests sophisticated modeling of project pipelines and risk coefficients. This precision contrasts with broader hydrogen market uncertainties, where demand projections and production scaling timelines remain subject to significant revision.

The insurance market’s emergence as a critical hydrogen sector component indicates that risk management costs may represent substantial project economics factors. Traditional energy projects typically allocate 1-3% of capital costs to insurance premiums, yet hydrogen’s novel risk profile could require higher coverage ratios that impact overall project viability.

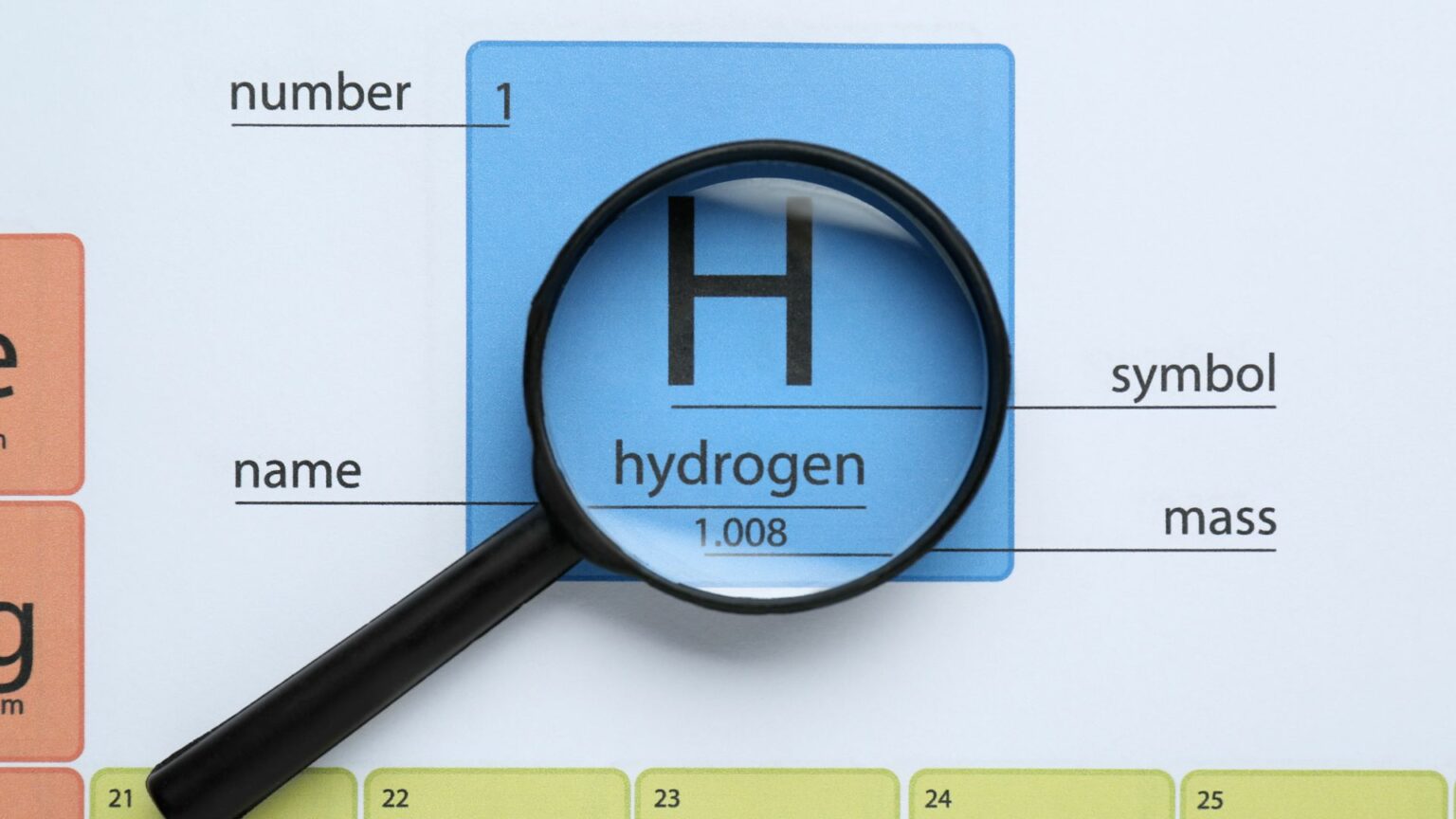

Safety considerations in green hydrogen facilities require specialized assessment given hydrogen’s unique characteristics and properties, according to MAPFRE Global Risks analysis. These characteristics include hydrogen’s wide flammability range, low ignition energy, and tendency for embrittlement of storage materials—factors that distinguish hydrogen infrastructure from conventional industrial installations.

The insurance market development timeline aligns with hydrogen industry scaling, where initial project experience will inform risk assessment models and premium structures. Early project performance data will be critical for refining actuarial models that currently rely on theoretical risk analysis rather than operational experience.

Europe’s $199 billion investment concentration creates geographic risk clustering that could complicate insurance market development. Large-scale infrastructure damage from single events could impact multiple projects simultaneously, requiring reinsurance mechanisms that may not yet exist for hydrogen-specific risks.

The report’s five-fold hydrogen demand projection by 2050, with 60% clean production by 2035, assumes successful risk management and insurance market development that enables sustained project financing. However, insurance market capacity constraints could limit project deployment if risk assessment reveals higher-than-anticipated loss potentials.

Current insurance market preparation for hydrogen infrastructure suggests recognition that traditional energy insurance models inadequately address hydrogen’s unique characteristics. The development of specialized coverage products indicates industry acknowledgment that hydrogen represents a distinct risk category requiring dedicated expertise and capital allocation.