The European Investment Bank’s in-principle approval of $135 million for ATOME’s Villeta project represents a significant bet on green hydrogen economics in a market where multilateral development banks deployed a record $125 billion in climate finance during 2023, yet Paraguay has received just €270.1 million from the EIB since 1959. This financing gap between global climate targets and regional investment history raises critical questions about the scalability and risk profile of first-generation green fertiliser ventures in emerging markets.

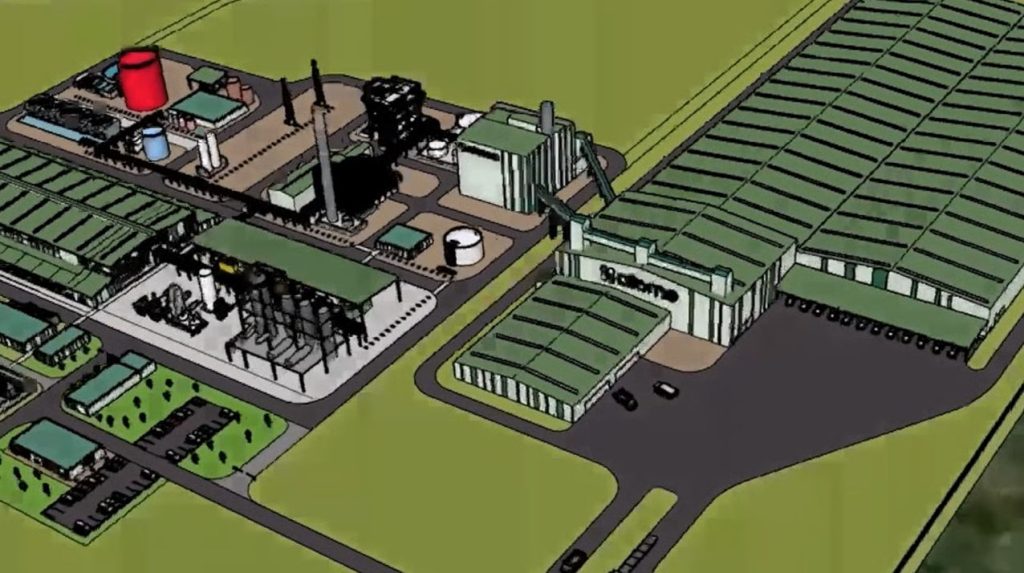

ATOME’s 260,000-tonne-per-annum Calcium Ammonium Nitrate facility with 110 MW electrolysis capacity positions the project as one of the largest green hydrogen applications in Latin America, yet the economics remain unproven at commercial scale. The $465 million fixed-price EPC contract with Casale S.A. establishes cost certainty for construction but creates financial pressure that requires sustained operational performance to justify the substantial capital deployment.

Development Finance Concentration and Geographic Risk

Multilateral development banks doubled climate finance volumes from 2019 to 2023, reaching $125 billion, yet this growth concentrates in established markets rather than expanding to untested geographies like Paraguay’s fertiliser sector. The EIB’s historical €270.1 million Paraguay investment over 65 years indicates limited institutional familiarity with local market conditions, regulatory frameworks, and operational challenges that could affect project viability.

The Green Climate Fund’s $50 million concessional funding approval complements the EIB financing, yet both institutions’ involvement reflects development finance appetite for green hydrogen projects that may exceed commercial risk tolerance. The combination of multilateral funding sources suggests that private capital markets view the technology and market risks as requiring substantial public sector support to achieve financial viability.

Hy24’s participation as anchor equity investor provides specialized clean hydrogen expertise, though the fund’s limited operating history in commercial-scale green hydrogen projects means the investment represents exploratory rather than proven strategy deployment. The equity structure’s dependence on a single anchor investor creates concentration risks that traditional infrastructure projects typically avoid through broader syndication.

Technology Scaling and Market Penetration Challenges

The project’s 145MW solar capacity combined with 110 MW electrolysis represents substantial technology integration risks where component failure could compromise entire facility operations. Unlike conventional fertiliser plants with established operational parameters, green hydrogen production introduces process complexity that requires simultaneous optimization of renewable generation, electrolysis efficiency, and ammonia synthesis.

ATOME’s planned Phase 2 300MW Yguazu expansion assumes successful Phase 1 operations and market acceptance, yet fertiliser markets historically demonstrate price volatility that could undermine long-term project economics. The company’s development pipeline creates operational leverage where Villeta’s performance will influence access to financing for subsequent projects, concentrating business model risks in the initial deployment.

The 2028 operational target provides limited timeline flexibility for addressing technical challenges or supply chain disruptions that commonly affect first-generation technology deployments. Unlike software development, where iteration cycles allow rapid adjustment, industrial-scale green hydrogen production requires extensive commissioning periods and operational optimization that may extend beyond projected timelines.

Regulatory Environment and Policy Dependency

Paraguay’s regulatory framework for green hydrogen production remains undeveloped compared to European market,s where policy support structures have matured over decades. The project’s dependence on long-term power purchase agreements in a market with limited renewable energy precedent creates regulatory risk that extends beyond technical and commercial considerations.

EIB survey data showing 90% of Paraguayans demanding stricter climate policies suggests public support for environmental initiatives, yet popular opinion may not translate into sustained regulatory stability for complex industrial projects. The gap between public environmental preferences and industrial policy implementation creates uncertainty about long-term government support for green hydrogen initiatives.

The EIB’s target to mobilise €1 trillion in climate investments by 2030 requires substantial expansion beyond current deployment rates, creating pressure for rapid project approval that may compromise due diligence standards. The institutional imperative to meet climate finance targets could influence risk assessment procedures in ways that prioritize deployment speed over financial prudence.

Financial Structure and Execution Risks

ATOME’s September 2025 Financial Investment Decision deadline creates compressed timelines for equity syndication and final debt documentation that may force sub-optimal financing terms or project modifications. The coordination required between EIB, Green Climate Fund, and Hy24 involves multiple approval processes and documentation requirements that increase execution risk compared to single-source financing arrangements.

The project’s first-of-kind designation for large-scale green fertiliser production means comparable transaction precedents are limited, reducing lenders’ ability to evaluate risk through historical performance data. This novelty premium may manifest in higher financing costs or more restrictive operational covenants that compromise project flexibility during the critical initial operating years.

ATOME’s positioning as a “leading developer of international green fertiliser projects” requires scrutiny given the company’s limited operational history and the nascent state of commercial green hydrogen production. The gap between development ambitions and proven execution capabilities creates performance risks that multilateral lenders typically mitigate through extensive due diligence and technical advisory engagement that may be compressed by accelerated project timelines.