Europe’s ambition to import 10 million tonnes of renewable hydrogen annually by 2030 hinges on more than just production capacity—it depends on overcoming logistical and infrastructure bottlenecks. A recent development by Höegh Evi and Wärtsilä Gas Solutions addresses a central hurdle: how to cost-effectively transport and convert hydrogen at scale. Their new floating ammonia-to-hydrogen cracker, capable of producing up to 210,000 tonnes of hydrogen per year, positions itself as a flexible, modular solution to decouple Europe’s energy strategy from grid constraints and port-side limitations.

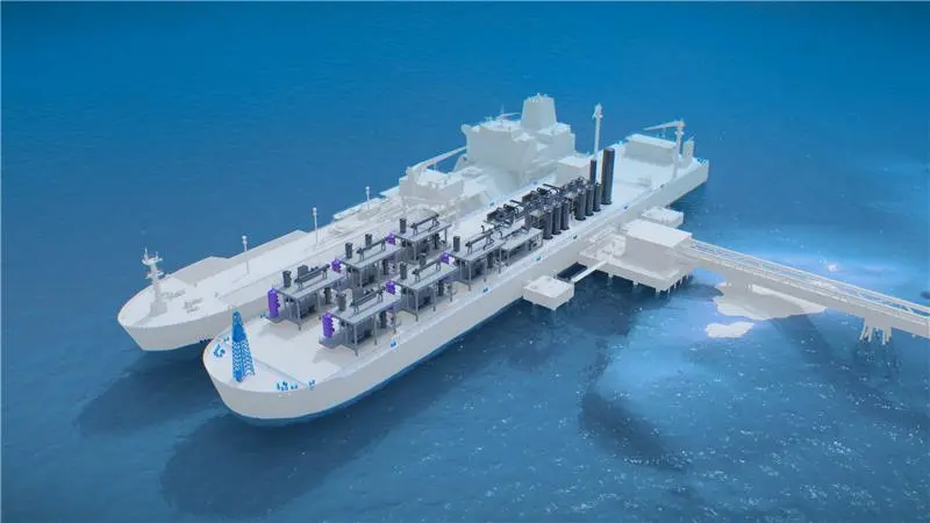

Announced in 2023 and supported by €5.9 million from Norway’s Green Platform programme, the project taps into the marine energy legacy of a country that pioneered LNG shipping decades ago. The cracker’s integration into Floating Storage and Regasification Units (FSRUs) and dedicated floating hydrogen terminals allows it to operate independently of fixed infrastructure. That flexibility could be decisive in early hydrogen market development phases, where permitting delays and infrastructure inertia pose risks to 2030 targets.

The core appeal of ammonia as a hydrogen carrier lies in its energy density and existing global transport network. Ammonia can be moved using current maritime infrastructure and stored in relatively mature conditions compared to liquefied hydrogen. The missing link has been economically viable and scalable ammonia cracking at the point of use—a gap Höegh Evi and Wärtsilä now aim to fill. Their unit, tested at the Sustainable Energy Catapult Center in Stord, Norway, supports ammonia storage between 10,000m³ and 120,000m³ and is designed for modular deployment across varying port geographies.

Yet even as the technology scales, questions of system efficiency and emissions footprint remain. Cracking ammonia back into hydrogen typically requires significant energy input and must manage nitrogen oxide emissions. Project documentation has yet to detail energy conversion efficiency or whether the cracker can integrate with renewable power sources to ensure low-carbon performance throughout the chain.

Still, the strategy of deploying floating import terminals offers an interim pathway as Europe builds out its internal hydrogen backbone. With terrestrial hydrogen pipelines such as the European Hydrogen Backbone (EHB) in planning or early development, floating terminals could serve industrial clusters before grid connectivity matures. These clusters—steel, chemicals, heavy transport—require dependable baseload energy that green electricity alone may not reliably deliver, especially during seasonal dips in renewable generation.

In this context, the Höegh Evi–Wärtsilä initiative is more than a technical milestone—it reflects a shift toward hybrid solutions in energy logistics. By embedding flexibility in location, volume, and timing, floating ammonia crackers reduce Europe’s dependency on fixed-site development timelines and help derisk early-stage hydrogen supply chains.

Höegh Evi’s broader portfolio includes several European hydrogen terminal projects scheduled to come online before 2030, indicating alignment with EU policy timelines. If the technical performance of the cracker meets operational expectations, it could become a cornerstone technology in Europe’s diversified hydrogen import strategy, alongside pipelines from North Africa, liquid hydrogen routes, and domestic electrolyser buildout.

As European policymakers refine the regulatory framework around ammonia imports and hydrogen certifications, real-world deployments like this will play a crucial role in testing commercial viability. The balance between ambition and delivery will rest heavily on projects that, like this one, address both infrastructure challenges and scalability in practice.