The global energy landscape is gradually changing and natural geologic hydrogen could become a key player in the coming energy revolution. Unlike conventional hydrocarbons, hydrogen is a future that is only available to those who study the topic in depth.

For investors who are looking for long-term and promising investments, natural geological hydrogen is the chance that must be seized now.

The question is who will dare to enter the new era of energy on a large scale and confidently, and who will remain on the old, though still prevailing traditional technologies. In order to assess this trend, it is important to understand how exactly natural geological hydrogen is formed (discard all mainstream but unfortunately not working on a commercial scale hypotheses) and why its extraction and use is not just an alternative to hydrocarbons, but the only way to the future energy transition in terms of the market price of the obtained energy and its environmental benefits.

THE EARTH AS IT HAS NEVER BEEN KNOWN BEFORE

Until now, the Earth has been perceived as a planet with finite hydrocarbon reserves, which in turn were and still are formed exclusively by organic means. However, this is a myth. Starting with the theories of D.I. Mendeleev and V.N. Larin, the concept of organic origin of oil was finally debunked. In reality, hydrocarbons are formed in the bowels of the Earth through a complex process of deep degassing of hydrogen from the metal hydride core of the planet.

Hydrogen, which is the building block of these compounds, is formed in huge quantities and continues to come from the Earth’s core, combining with carbon, which is abundant in the Earth’s crust (it is found in black and coal shales, graphite, carbonates, clays and evaporites), it contributes to the formation of oil and gas, which we use.

This means that hydrocarbon reserves are virtually inexhaustible – they are recoverable (will be replenished in existing oil and gas fields) in a geologically short time, about 10-15 years in all currently exploited oil and gas fields in the world. I am not going to prove it in this article – it is not about that, but this information is already so much that you yourself can easily find it on the vastness of the Internet.

NATURAL GEOLOGIC HYDROGEN AS A GLOBAL ENERGY RESOURCE

Today we are witnessing a real rethinking of energy sources. Geological hydrogen is not just an element, it is a powerful energy resource that can be used as a major energy source, replacing oil and gas in the future energy transition. It is many times more environmentally friendly: its combustion produces only water as a by-product. Unlike hydrocarbons, whose combustion leads to carbon monoxide and greenhouse emissions, hydrogen does not pollute the atmosphere.

Natural geologic hydrogen is present in significant quantities at depths ranging from 1.5 km to 60 km beneath the Earth’s crust. Moreover, the Earth’s crust contains it not a fraction of a percent, as hitherto thought, but about 60% volumetrically and 5% by weight. That is, the Earth is oversaturated with hydrogen. It is released from the planet’s core through the Earth’s crust into the atmosphere, where its constant concentration is kept at the level of 2.5 million tons. In addition, in the process of such hydrogen degassing, about 250 thousand tons of hydrogen escapes into space every year.

THE FUTURE OF ENERGY: GEOLOGIC HYDROGEN ON A PEDESTAL

Investing in natural hydrogen is not only supporting an innovative approach to energy production, but also a chance to be part of the global energy transformation while providing value for investors.

Forecasts show that in the future, hydrogen will take the place of the hydrocarbons we currently extract from conventional deposits. Unlike artificially produced hydrogen of all colors, which have high production costs and complex production technologies, geological hydrogen is available now and can be extracted from the subsurface at minimal cost.

At the same time, global resources of natural geological hydrogen are huge and are constantly replenished due to processes of its degassing from metal-hydrides of the planet’s core to its surface. Natural geological hydrogen is much cheaper than hydrogen produced artificially (remember that production of green hydrogen by hydrolysis of water is an energy-negative process from the point of view of elementary physics and is not competitive on the open market without government subsidies).

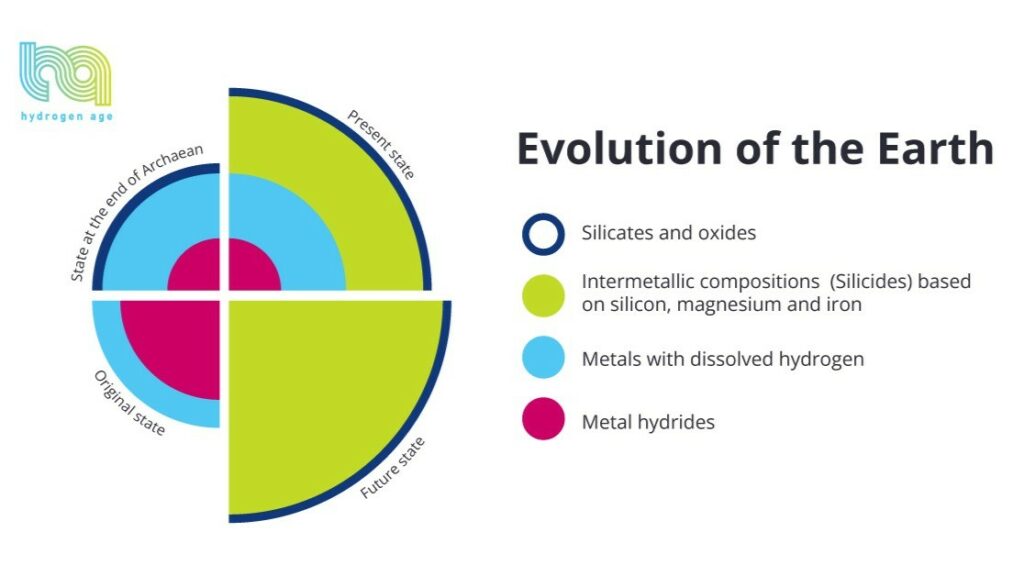

The following figure shows a schematic of the Earth’s evolution, taking into account the influence of natural geologic hydrogen on the process of its expansion and morphology change.

TWO KEY CONCLUSIONS CAN BE EMPHASIZED FROM THIS

1. The Earth continues to expand, forming faults and fractures through which natural geologic hydrogen rises to the surface.

2. The process of degassing natural hydrogen allows it to be extracted on an industrial scale.

RISKS AND OPPORTUNITIES FOR VENTURE CAPITALISTS

For venture capitalists considering investing in this new industry, it is critical to carefully analyze the scientific underpinnings of the companies in which they intend to invest. There are already more than 100 startups in the market today claiming to invest in natural hydrogen. However, many of them are using outdated or simply incorrect scientific theories.

If you are an investor looking for real technology and noteworthy cases, look out for red flags that signal problems in the project:

1. Lack of correct scientific basis

Many companies make big claims, but their geologic models can’t answer the standard questions outlined here. They use approaches that have yielded NO results to date.

How do you test it?

– Ask the question: what model are they basing their hypothesis on? If they tell you that these are laboratory studies of serpentinization/ferrolysis/radiolysis theories working only in a narrow range and controlled conditions of temperature and pressure – you can ask no more questions. Under natural conditions this story is quite different.

2. Misguided exploration methodologies

Some companies search for hydrogen using techniques designed to find hydrocarbons, but these techniques fail to find commercial flows of natural hydrogen – because it doesn’t form deposits (fields) like in the oil and gas industry. The reasons are also known: the small size of the molecule for which there are no natural barriers.

How to test for it?

– Ask for information about their exploration methods. If they are using standard oil and gas geological exploration methods (e.g. looking for natural hydrogen deposits ), their search is probably doomed.

3. Declaratory discoveries without evidence

There are companies that loudly proclaim “giant discoveries” yet they have no wells or their wells drilled during oil and gas exploration and abandoned for geologic reasons are not degassing hydrogen – this means NOTHING.

How to check?

– Demand data on well production rates over time (like in Mali, for example).

BEFORE INVESTING IN ANY STARTUP, ASK THE FOLLOWING QUESTIONS OF THE STARTUP TEAM:

– What are the scientific hypotheses on which their exploration is based?

– What evidence supports their model for the formation of hydrogen clusters?

In the article “Mistakes no one wants to admit”, I detailed why there have been no commercial discoveries of natural hydrogen in the last two years, despite the millions of dollars attracted to the industry and the dozens of wells drilled to do so. The main reason is the use of flawed theories that do not lead to actual discoveries.

CONCLUSION: WHO TO INVEST IN ?

Investing in natural hydrogen exploration is a difficult but promising choice. Exploration of natural hydrogen requires a much deeper understanding of the processes than classic oil and gas exploration, and therefore the old methods do not work here.

The fact remains that despite the aggressive attraction of investment in this field, no startup has yet been able to confirm commercial production of natural hydrogen. Moreover, even large oil and gas companies with vast resources and expertise have yet to achieve even casual discoveries in this field.

Therefore, if you are considering investing in this sector, analyze the “professional baggage” of each startup more deeply before making a decision. This will help you avoid losses and invest in really promising projects.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy News. This content is presented as the author’s analysis based on available information at the time of writing. It should not be considered as representative of Energy News or its editorial stance. Readers are encouraged to consider this as one perspective among many and to form their own opinions based on multiple sources.