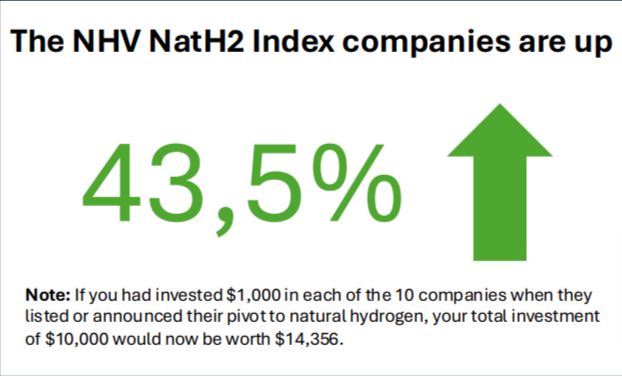

The launch of the NHV NatH2 Index marks an attempt to standardize the tracking of natural hydrogen companies on the stock exchange.

This index, which includes 10 companies offering substantial exposure to natural hydrogen, aims to provide investors with a focused view of this emerging sector. However, the effectiveness and relevance of this index deserve closer scrutiny, particularly in the context of industry benchmarks and the underlying data.

The NHV NatH2 Index comprises 10 equal-weighted companies, including names like HyTerra, Gold Hydrogen, and Buru Energy. The selection criteria are based on the companies’ exposure to natural hydrogen, as an estimated percentage of their overall activities. While this focus on exposure is commendable, the index’s reliance on publicly available data raises concerns about the accuracy and completeness of the information used. The decision to update the index weekly based on Friday’s closing prices may provide a snapshot of the market, but it also introduces potential volatility, which could obscure long-term trends.

The stated goal of the NHV NatH2 Index is to encourage further investor interest in natural hydrogen. However, the utility of this index for investors is questionable. The index’s focus on companies that are generally too “late-stage” for early-stage investors might limit its appeal to those seeking high-growth opportunities. Moreover, the speculative nature of the companies involved means that the index could be highly volatile, potentially misleading investors who are not well-versed in the risks associated with emerging markets.