Austria’s push to anchor green hydrogen as a pillar of industrial decarbonization gained financial clarity this week as OMV secured production funding of up to EUR 123 million for its planned electrolyzer plant in Bruck an der Leitha.

The funding agreement with Austria Wirtschaftsservice GmbH follows a positive assessment by the European Hydrogen Bank, positioning the project among the early large-scale hydrogen investments to reach both European and national support thresholds.

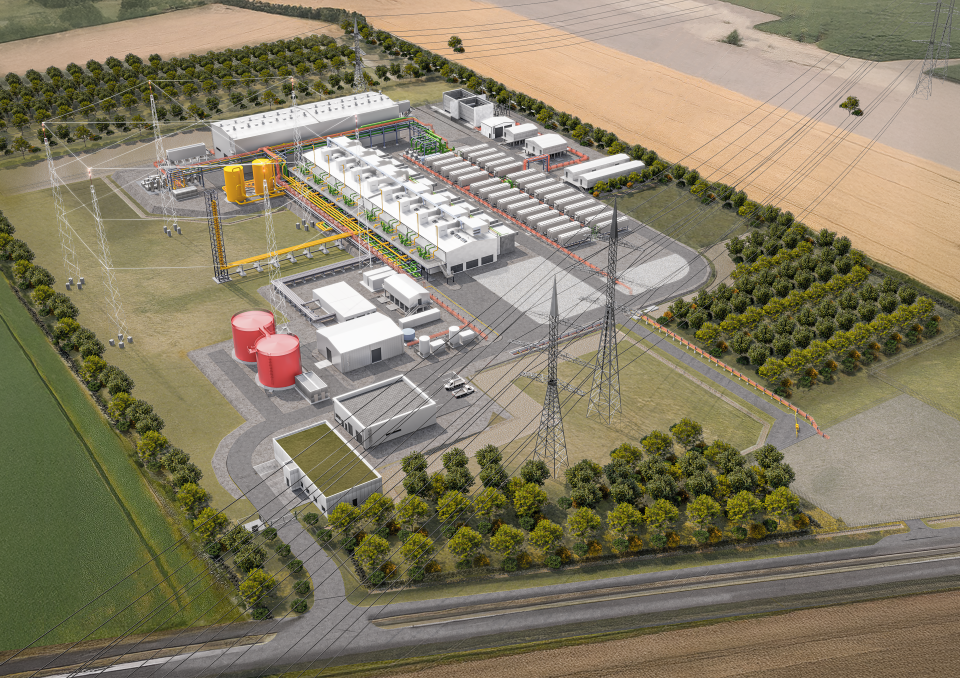

The scale of the project highlights how hydrogen policy in Europe is shifting from pilot schemes toward infrastructure-sized commitments. With a planned capacity of 140 MW, the Bruck an der Leitha facility is designed to produce up to 23,000 metric tons of green hydrogen annually once operational at the end of 2027. OMV estimates this output could reduce carbon emissions by as much as 150,000 tons per year by displacing fossil-based hydrogen and fuels in refining operations, a figure broadly consistent with emissions factors used in European industrial decarbonization assessments.

OMV’s total investment, described as being in the mid-hundreds of millions of euros, underscores the capital intensity that continues to define electrolytic hydrogen at scale. Even with public funding support, the economics remain closely tied to renewable power availability, electrolyzer utilization rates, and long-term offtake certainty. The European Hydrogen Bank’s endorsement signals confidence that the project aligns with EU criteria on additionality, emissions reduction, and cost efficiency, but it also reflects how dependent early projects remain on state-backed risk sharing.

A key structural feature of the project is its physical integration into OMV’s existing industrial footprint. The hydrogen plant will be connected to the Schwechat refinery via a dedicated 22-kilometer pipeline, allowing direct substitution of grey hydrogen currently used in fuel and chemical production. This configuration reduces transport losses and avoids the need to build new hydrogen demand from scratch, a challenge that has slowed other projects lacking nearby industrial offtakers.

The renewable electricity mix planned for the facility draws on wind, solar, and hydropower, reflecting Austria’s relatively favorable clean power profile compared with many European peers. Still, ensuring consistent electrolyzer operation will require careful balancing of intermittent generation and grid supply, particularly if the plant is to reach the load factors needed to approach cost competitiveness with fossil alternatives.

From a strategic perspective, the project sits squarely within OMV’s Strategy 2030, which emphasizes transforming the company’s fuels and chemicals operations to lower-carbon pathways rather than exiting them outright. Green hydrogen plays a dual role in that framework, serving both as a decarbonization lever for existing assets and as a potential growth vector should demand for low-carbon fuels and feedstocks scale as projected.

The planned joint venture with Masdar adds another layer to the project’s risk allocation. Signed in November 2025 and expected to be finalized in early 2026 pending regulatory and shareholder approvals, the partnership would see Masdar participate in financing, construction, and operation of the electrolyzer plant. For OMV, bringing in a global clean energy investor reduces balance sheet exposure and provides access to project development expertise in large renewable-linked assets. For Masdar, the deal offers a foothold in Central Europe’s emerging hydrogen market anchored by a committed industrial offtaker.