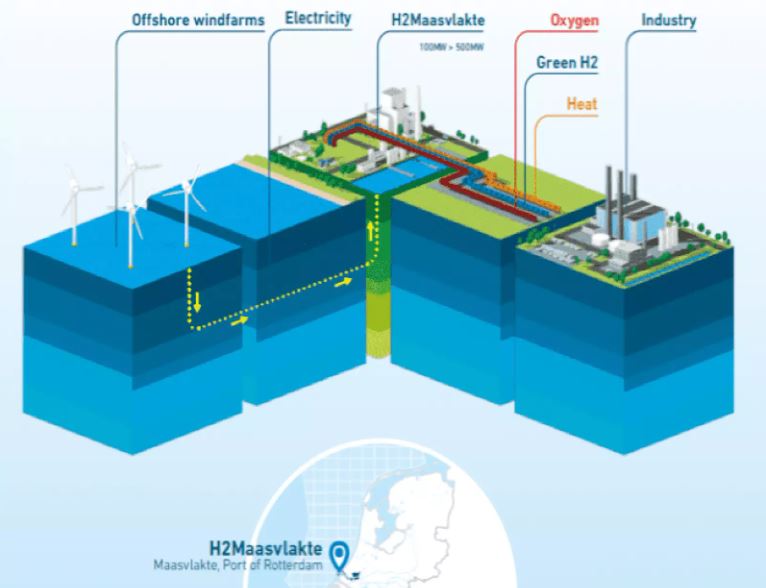

Uniper has recently encountered delays in its flagship green hydrogen project, H2Maasvlakte, situated in the Port of Rotterdam, Netherlands.

The project, which was initially slated for rapid advancement, now faces uncertainties regarding its timeline and feasibility, raising questions about the broader landscape of green hydrogen initiatives.

Despite being on track for a final investment decision (FID) and receiving EU subsidies, Uniper acknowledges that the H2Maasvlakte project is likely to experience delays, with hydrogen production now expected to commence as late as 2030. The company attributes this setback to various factors, including insufficient offshore wind availability and regulatory hurdles surrounding power purchase agreements (PPAs).

Uniper’s inability to secure a PPA stems from the stringent EU regulations governing the qualification of hydrogen as “renewable.” These regulations mandate that only offshore wind farms built within three years of an electrolyser can supply power to green hydrogen projects, posing logistical challenges for securing timely agreements. Additionally, escalating grid fees in the Netherlands further compound the financial constraints associated with green hydrogen production.

Policy gaps and subsidy uncertainty

The absence of clear regulatory frameworks, particularly in Dutch law, exacerbates the uncertainty surrounding green hydrogen projects like H2Maasvlakte. While the updated Renewable Energy Directive outlines ambitious hydrogen targets, the lack of specific legislation complicates the identification of sectors incentivized to adopt renewable hydrogen and the availability of support mechanisms for potential offtakers. Moreover, the withdrawal of Uniper’s grant from the Innovation Fund underscores the volatility of subsidy landscapes, prompting the company to explore alternative funding avenues.

Uniper’s challenges reflect broader industry dynamics and competition within the green hydrogen sector, particularly in the Port of Rotterdam. Competing projects, such as Shell’s Holland Hydrogen 1 and BP-HyCC’s H2-Fifty, underscore the race to establish green hydrogen dominance. However, each project faces its own set of complexities and uncertainties, highlighting the intricate interplay of regulatory, financial, and technological factors shaping the future of green hydrogen initiatives.