Electric Hydrogen’s 100 MW HYPRPlant will power what’s projected to become the world’s largest eFuels production facility—Infinium’s “Project Roadrunner” in Texas.

With commercial eFuels production slated for 2027, Project Roadrunner signals a broader shift in the hydrogen economy: away from pilot-scale demonstrations and toward industrial-scale, revenue-generating projects. The facility will generate sustainable aviation fuel (eSAF), eDiesel, and eNaphtha from renewable hydrogen and captured CO₂—targeting sectors where decarbonization remains technically complex and infrastructure-heavy, including aviation, shipping, and heavy trucking.

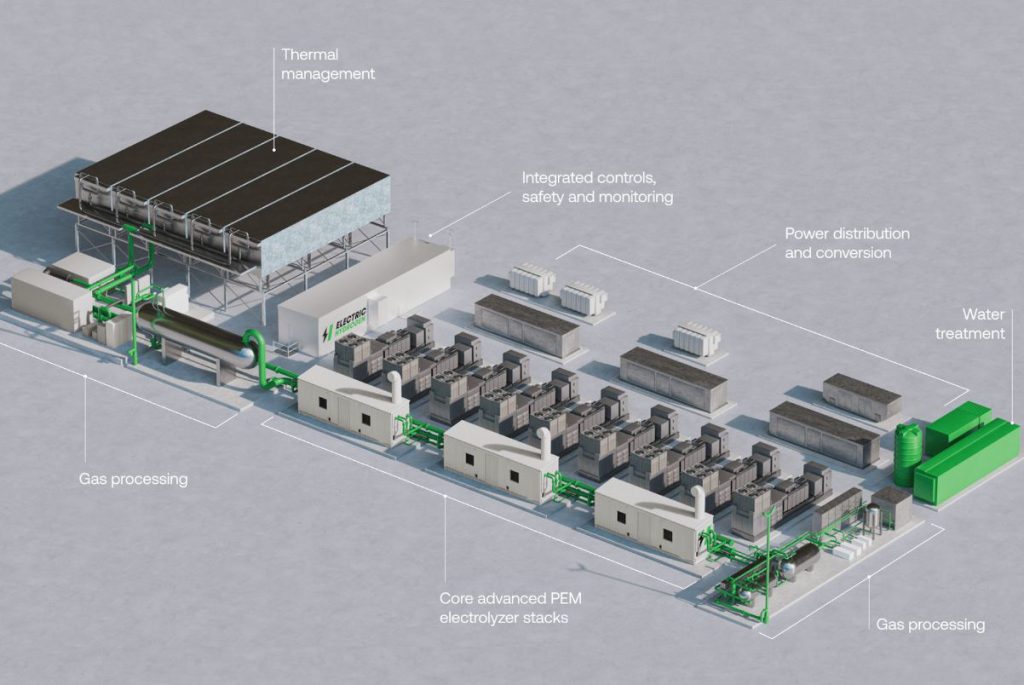

At the heart of this transition is Electric Hydrogen’s HYPRPlant platform, which claims to reduce total installed electrolyzer system costs by up to 60% compared to conventional technologies. While that figure has not yet been independently verified, the company’s approach—vertically integrated U.S. production, modular design, and onshore manufacturing of key components in Massachusetts and Texas—offers a notable alternative to dominant suppliers, particularly from China and Europe. Whether this model is economically replicable at scale remains a key question, but the bet is clearly attracting interest.

Infinium’s choice of supplier also carries financial and geopolitical weight. Project Roadrunner is being underwritten by Brookfield Asset Management and Breakthrough Energy Catalyst, a Bill Gates-backed investment platform. These backers not only validate the commercial viability of the HYPRPlant solution but also reflect a broader push for strategic clean energy manufacturing independence in North America. The project is being hailed as the first large-scale eFuels facility to achieve project-financed status, with International Airlines Group (IAG) already committed to a 10-year offtake agreement.

For Texas, the project offers a strategic reconfiguration of the state’s industrial workforce. The new facility in West Texas is expected to draw heavily on local oil and gas expertise, providing a pathway for skilled workers to transition into the hydrogen economy. However, questions remain about how quickly legacy sectors can adapt, and whether supply chains for renewable hydrogen—including electricity, CO₂ capture, and water—can scale to meet commercial expectations.

Electric Hydrogen’s recent partnership with Titan Production Equipment and its designation as Uniper’s exclusive electrolyzer provider for a 200 MW project in Germany further strengthen its international credibility. But with competitors like Siemens Energy, ITM Power, and multiple Chinese manufacturers scaling aggressively, the firm will need to prove that cost reduction claims can hold up under global market pressure and policy shifts.

Stay updated on the latest in energy! Follow us on LinkedIn, Facebook, and X for real-time news and insights. Don’t miss out on exclusive interviews and webinars—subscribe to our YouTube channel today! Join our community and be part of the conversation shaping the future of energy.